![]() Rated #3 Best Property Crowdfunding Site

Rated #3 Best Property Crowdfunding Site

PROS:

- Invest from just a £10 starting deposit

- Choice of accounts to suit all needs

- No hidden fees or extra charges

CONS:

- Limited range of investment types

- Not covered by the FSCS (financial services compensation scheme)

- You don’t get to choose which properties you invest in

Recently launched, peer-to-peer lending platform Loanpad is making waves in the property investment market.

Loanpad provides clients with the opportunity to pay into an online account and invest in property-backed loans.

Loanpad are keen to expand their operation. The company has launched a huge marketing campaign, and released new features – including automated re-investment and automated withdrawal.

Want to know more? Then check out our Loanpad review.

At A Glance

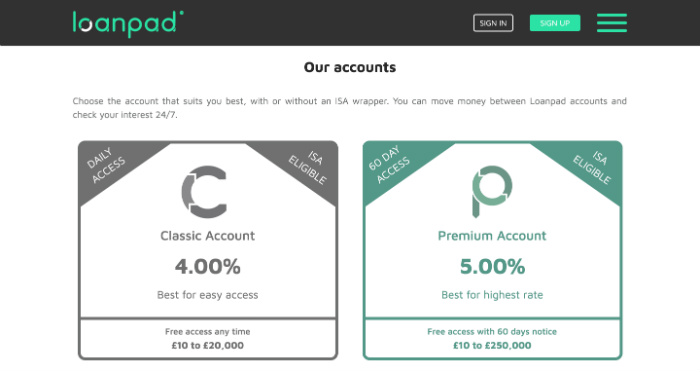

Designed with simplicity and flexibility in mind, Loanpad offers a choice of two online lending accounts (also available as ISA’s for those who like the idea of tax-free returns).

The concept is straight-forward, Loanpad provides a platform so you can lend money (short-term property loans) directly to borrowers, and earn a good amount of daily interest in return.

By investing with Loanpad you are guarding your savings from inflation, increasing your investment, so you will have a nice little pot of money for the future. Loanpad appeals to investors who are looking for accessibility and prefer a relatively low-risk option.

What Fees Do Loanpad Charge?

There are no fees to speak of, so you won’t get hit by any hidden charges and there’s nothing to pay in advance. Loanpad are very transparent about how they make money – they earn a return in the same way you do.

So basically, when you receive interest on your account, they receive a small percentage of it. There is one extra fee and that’s associated with the premium account, this is an additional charge for accessing your money prior to the 60-day notice period.

How Safe Are Loanpad Investments?

As with any investment, there is always a small degree of risk. However, Loanpad are quick to point out that they carry much of the risk on your behalf.

There are also a number of measures in place to put investor’s minds at ease:

- Loanpad have forged robust partnerships with reputable property lenders.

- Property lenders assume the “junior tranche” (the riskier part of the loan), and take at least 25% of the loan.

- Loanpad only offers loans up to 50% loan-to-value (LTV)

- Invested money is spread out across a number of loans, so if there’s an issue with one borrower it won’t be too damaging to your investment pot.

- If a borrower does default on repayment you will still get your money back prior to the property lender getting their share.

- Loans are fortified by property that can be put on the market if needs be, so you should get your money back in the unlikely event of any problems.

- Loanpad has a talented team of solicitors and surveyors on hand to ensure every investment is sound.

- Loanpad has a ring-fenced fund in place (the interest cover fund) just in case a borrower defaults on payment. If this happens you should still get your interest payments in full and on a daily basis.

- You are in control and choose how much you invest and when and how you do it – you can invest a large amount in one go, or add smaller amounts as and when it suits.

Essentially, with Loanpad you can invest in property deals you wouldn’t normally be able to get involved in, and you are well-protected from the risks involved.

Plus, all investment opportunities are scrutinised. The team check out the credit history of the borrower, look into their background, explore their assets and liability, and determine how well they have repaid loans in the past.

How Investing with Loanpad Works

You get to choose the right account for you – go for the ISA option if you want to, or stick to the regular accounts. You need to register by providing your personal details. Loanpad will verify your application after checking you are who you say you are!

Once approved you can put money into an account via bank transfer or a standing order. You choose the amount (the minimum investment is just £10). The money is then transferred to the classic or premium account – depending on which option you go for.

The Classic Account

The classic account (which is ISA eligible) allows you daily access to your money, so this is great for those who like the idea of being able to get hold of their cash when they need to.

You can invest from as little as £10 all the way up to £20,000, and there’s an annual rate of 3.6% paid into your account on a daily basis (prior to tax).

Loanpad do stipulate that this rate could change, so you do need to keep an eye on it.

There are no fees for the classic account.

The Premium Account

The premium account is slightly different. Again, this account is ISA eligible, but you don’t get instant access to your money. You need to provide 60 days’ notice should you wish to access your cash.

However, the rate for this account is better (4.8% instead of 3.6%) this is calculated after fees and prior to tax, and the rate is open to change. You can invest anything from £10 up to £250,000 in a premium account.

The good news is you can move your hard-earned cash between accounts and you can get a view of what’s happening with your money at any time, day or night.

You can also boost your returns even more by reinvesting the daily interest you earn. A good way of making that pot of money grow even bigger!

Loanpad Reviews From Customers

Easy to use, and payments are processed 12 noon each day. My money was invested within a day and the company looks like it has great potential.

Yuz via Trustpilot review

Easy to use website, can select from normal or ISA investment, good rates of interest, easy to access funds. Can’t see any problems.

Gillian via Trustpilot review

So, Is Loanpad Any Good?

Loanpad offer a comprehensive service, and really look after their investors. They seem to have all bases covered, sourcing and sanctioning viable loans, keeping track of progress, collecting re-payments and ensuring you get a good return via inflation-busting daily interest.

Let’s explore positives and negatives to find out if Loanpad could work for you.

Positives of Loanpad

- A comprehensive service, Loanpad look after everything on your behalf, managing your investment and minimising risk.

- Loanpad offer a user-friendly service that’s transparent and easy to get to grips with.

- Inflation-busting interest paid into your account each and every day.

- Access to good investment opportunities in partnership with reputable property lenders.

- Loanpad vet property lenders and borrowers, so you can be sure the investments are sound.

- You stay in control of your money, and have the flexibility to move your money around.

- Choose from two accounts, the classic or premium (both ISA eligible).

- No hidden fees or extra charges.

- You can open a loanpad account easily providing you are over 18, have an address in the United Kingdom and have a bank account in the UK too.

- Option to boost your returns by reinvesting the interest you earn, making interest on your interest will really enhance your earnings.

Plus, there’s an easy to use dashboard where you can check out your account, keep track of your money and change your preferences.

Loanpad are also FCA regulated and licensed as an ISA manager with HMRC.

Negatives of Loanpad

- You don’t get to choose where your money is invested.

- As with all investments there is an element of risk, after all investment values can fall as well as rise.

- The FSCS (financial services compensation scheme) does not cover Loanpad, so if you make a loss you won’t be bale to claim any compensation.

- The economic climate can be volatile, the world is an unpredictable place! Events beyond your control could have an impact on your investments.

A Short History of Loanpad

Launched in the UK at the end of January 2019 by founder and CEO Louis Schwartz, Loanpad set about offering something unique -the chance for everyday folk to partner with reputable property lenders and invest in property.

These low-risk investments appeal to those who want to put their money into property investment, but aren’t sure how to go about choosing the best deals.

Schwartz wanted to make sure Loanpad appealed to the masses, so the team have worked hard to ensure the format is user-friendly and accessible to all.

The peer-to-peer lending platform may be relatively new, but it has already garnered plenty of interest and with plans afoot to market the business more and expand, Loanpad is set to grow and reach even more potential investors.

Loanpad Review – Summary

Loanpad feels inclusive, it’s a platform that welcomes investors regardless of whether they have £10 to spend or £250,000 to put in. It’s also a platform that allows you to buddy up with respectable property lenders, so you can muscle in on great deals with the added protection that the lenders are shouldering the high risk.

The deals and investments are well-vetted and borrowers are only authorised once they have been rigorously assessed, so you get to put your money in and won’t spend nights tossing and turning as you nervously wait to see what return you achieve.

Let’s remind ourselves what else makes Loanpad an interesting platform. For a start the accounts are ISA eligible, so you can take advantage of tax-free savings.

Add to this the fact that any money you put in is diversified daily to minimise risk, and that you get interest paid daily into your cash account, and you start to understand why Loanpad is an attractive option for cautious investors.