On 24 February 2021, The House Crowd entered administration and are no longer trading as a business. The review that follows is for historical purposes only and does not reflect our current opinion of the now defunct company.

The House Crowd review – The House Crowd is a crowdfunding site allowing people to develop an investment portfolio.

The company offers a number of investment plans, so you can choose one that suits your preferences.

Keen to find out more? Check out our House Crowd review.

At A Glance

In simple terms, The House Crowd allows people to get into investment without needing to raise a large sum of capital. Members can invest from £1,000, and these funds are collected to create the “crowd.” There are four different avenues of investment to provide the ideal solution for anyone.

In a nutshell, this platform allows users to:

- Make a smaller investment to enjoy a share of the returns

- Auto invest to diversify your portfolio

- Receive interest on your investment

- Lend money peer to peer

What Fees Do The House Crowd Charge?

One of the attractive features of The House Crowd is the fee transparency. The fees for equity investments are based on a percentage of the money that is raised for the investment. This is charged to the company formed for each specific project.

The fees are typically around 5%, but some users have reported higher fee rates. The specific fees for each investment are detailed in the information pack so you can check you’re comfortable with them before you decide if you want to invest.

However, you need to bear in mind that returns are paid out as a gross figure, so there are no deductions made for tax. You will need to take responsibility to account for your own tax liability.

How Safe Are The House Crowd Investments?

No The House Crowd review would be complete without discussing whether your funds are safe when you make an investment.

Whether you’re investing in property development or peer to peer lending, your money is secured by a legal charge over the property. This is registered with the land registry.

Before your money is invested, and while it is held by the solicitor, it is protected by the FSCS (Financial Services Compensation Scheme). However, once the funds are invested, FSCS protection no longer applies.

Once the property has been purchased, your money is protected as a legal charge on the property, and your rights and investment are protected by the company’s articles.

For example, if a loan exceeds its due date by 180 days, it is considered “in default.” When the loan is in default, investors benefit from a higher “default interest” rate. There is also a legal process that can be followed to take possession of the property, so it can be sold to repay the investors.

You can also limit the risk by diversifying and spreading your investments. The House Crowd does have an auto investment feature, so you can reduce your exposure.

The House Crowd does provide an information package that includes estimates of the potential returns. This information is garnered from reliable sources. However, the company cannot offer any guarantees that projections are accurate and that your funds will be returned. After all, projections are merely an estimate, and unforeseen issues can crop up.

Investment Term

You also need to bear in mind that your investment will have a specified term, which will tie up your capital for a fixed period. You can withdraw your funds after the end of the term, and no part of your money will be able to be withdrawn until the loan has been repaid.

Your capital will be repaid as a priority when a sufficient number of properties are sold. However, as we discussed above, there are no guarantees you will get your money back or receive interest on your investment.

If you want to sell a stake before the minimum period, The House Crowd states that they will help you to try to do this.

How Investing With The House Crowd Works

There are four avenues of investment available with The House Crowd.

Property Development Investment

Property Development Investment is based on building and selling new properties.

The House Crowd development team manage the project from start to finish, with a typical invesment period of 12 months. Once sufficient properties are sold, investors can reoup their capital and receive interest.

Peer to Peer Lending

The second type of investment is Peer to Peer Lending. This facilitates lending to a third party borrower for a term of 3 to 12 months. Your investment is secured against the borrower’s property and you’re paid your capital and interest when the borrower repays their loan.

Auto Investment

You can also Auto Invest with The House Crowd. You can choose from three investment tiers; cautious, balanced and bold for different interest rates. The combined pool of money generated with Auto Invest is spread across different investments and you’ll be paid interest twice a year. You can also withdraw from the fund with 30 days notice after the minimum 12 months.

Innovative Finance ISA

Finally, you can choose the Innovative Finance ISA, which allows you to invest your tax free ISA allowance. The investment funds are automatically invested for a diversified portfolio. You can transfer existing ISA balances of £5,000 or more and you’ll receive interest twice a year. After the minimum 3 year term, you can withdraw your funds by giving 3 months notice.

To fund your investment, you can use your debit card online or issue a money transfer. All The House Crowd payment transactions are handled by MangoPay SA or Woodland Corporate Services.

The money is held in an account covered by FSCS protection until the property purchase. This provides protection that should The House Crowd go bankrupt; your money is safe and will be returned to you.

So, is The House Crowd Any Good?

This The House Crowd review has so far provided an insight into what the company can offer, but is The House Crowd any good?

Does it provide investors with lots of investment opportunities and choices that are too good to walk away from? Or is it just an average crowdfunding platform that has few properties to look at?

- The House Crowd does offer a decent selection of investment options.

- The company also offers a comprehensive information package, so that you can assess the investment prospects to find one that suits your preferences and then allow The House Crowd to take care of all the other details.

- It seems that there are lots of good points, which will we will explore in more detail. However, in the spirit of transparency, we will also look at any negative points.

The Positives of The House Crowd:

Signing up with The House Crowd does afford some interesting benefits:

- Spread your investments across different projects

- A dedicated team to handle everything from listings and lettings to sales

- Invest in Peer to Peer lending

- All developer drawdowns are controlled by independent RICS fund monitor based on the current site valuations

- Access to a simple investor dashboard, so you can have access to all the relevant information and easily manage your investments.

- A track record of zero capital losses so far.

The Negatives of The House Crowd:

If you’re considering investing through The House Crowd, you do need to be mindful of some potentially negative issues.

- Firstly, every investment carries an element of risk, and there are no guarantees that you will receive your initial investment back and the projected returns.

- Returns can be unpredictable.

Some investors have struggled with a lack of control over their investment, with the term lasting longer than initially projected. So, keep in mind that you may need to play the long game and hold your investment for five years or more to secure the returns.

If you have a tendency to be impatient, this is not likely an investment opportunity for you.

A Short History Of The House Crowd

The House Crowd was launched in 2012 with the aim to simplify property and make it more easily accessible to people looking to build their financial future.

The founders, Frazer Fearnhead and Suhail Nawaz were fed up with poor rates on savings and pensions and wanted to offer access to higher returns.

The company states that by pooling investment power, House Crowd members can achieve a rate of return that was previously reserved for institutional investors and banks.

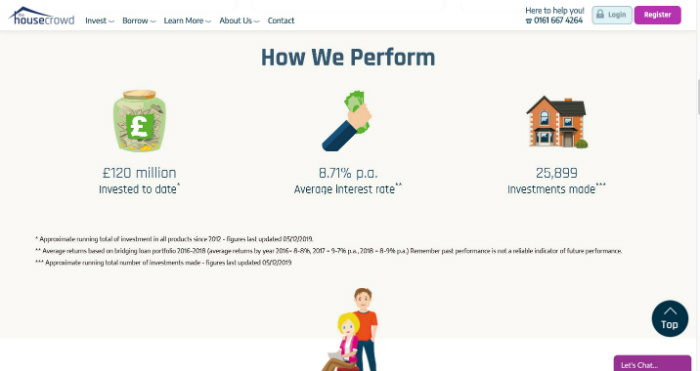

To date, The House Crowd members have invested over £120 million collectively through its crowdfunding platform. The company received the Shares Magazine best UK peer to peer lending platform award in 2018

The House Crowd Review – Summary

We’ve given The House Crowd a good look, and it appears to be a solid company. This is an impressive platform that allows those keen to enter the property investment niche an opportunity to access some great property deals without needing to tie up massive amounts of capital.

Although there are always risks, investing in physical properties could provide access to a healthy return.

The House Crowd aims to make it easier for everyone to build an investment portfolio, and they deserve credit for their efforts.