Buying a new home is a major commitment, and an expensive one.

But many householders discover that they face yet more expense when they find that they need to make unexpected repairs.

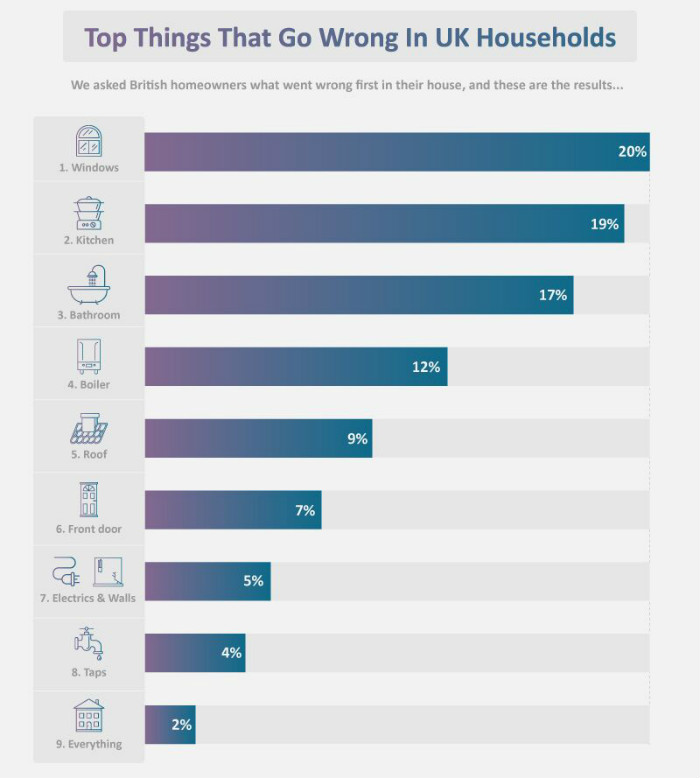

Research by website Money Guru discovered the top five unexpected repairs, and that as many as a quarter of households struggle to save for unexpected expenses.

Windows

The investigation by website Money Guru showed that windows were the most common household repair required. Twenty percent of British homebuyers stated that windows were the first change they needed to make when they moved into their new home.

However, as windows last on average around twenty years, they should be viewed as a long term investment in the home.

As anyone who has had windows replaced knows, they’re not cheap. The cost to replace windows in an average house with ten windows starts at almost £5,500. Not an amount to be sneezed at.

Kitchens

Kitchens are the second most common repair needed when someone moves home. Nineteen percent of respondents revealed that they had to replace or repair the kitchen in their new property. And with an average price tag of £8,000, it’s the most costly repair of all.

Bathrooms

Bathrooms come in in third place, with 17% having to replace an outdated or unsuitable bathroom. Again, it’s an expensive repair, with the cost of a brand new bathroom tipping the scales at £4,500, including fittings and installation.

Boiler

Perhaps surprisingly, boilers are only fourth on the list with 12% having to repair or replace theirs. With a working boiler being an essential rather than a ‘like to have’, homeowners can expect to spend anywhere between £500 and £2,500 on making their home snug again.

Don’t forget, there are plenty of boiler and heating cover plans available. One of our favourites is the one from Hometree. You can find out more in our Hometree review.

Roof

At number five, 9% of new homeowners find themselves having to have the roof repaired or replaced. While the cost varies depending on the materials used, the average cost of having a new roof fitted is £4,900, plus a great deal of inconvenience.

Further down the list

Continuing further down the list of required repairs were the front door (7%), electrics and walls (5%), taps (4%), and for some very unlucky people, ‘everything’ was the answer (2%).

Average spend on first household repairs

As might be expected from the average figures quoted above, almost a quarter of all British homeowners spent at £5,000 on the first repair they had to make, at 24%. Thirty one percent spent between £1,000 and £5,000, while a fortunate 17% said that their first repair came in at less than £100.

How are people paying for these repairs

The research by Money Guru also revealed that just 24% of homeowners were able to regularly save £50 per month to put towards household repairs. Even this would mean that it would take eight years to afford the average bill.

Twenty-five percent were found to be able to save ‘occasionally’, but 10% were unable to save anything at all, thanks to the rising costs of food, petrol and energy.

Despite people struggling to save, two thirds of householders are able to pay for repairs from existing savings. For the remaining 34%, various ways of raising money are utilised.

Fourteen percent added the cost of repairs to their mortgage, while 10% took out a loan. Four percent put the cost of the repair on a credit card, while 3% cut back on essentials or borrowed from family or friends.

Preparing and budgeting for unexpected household repairs

As can be seen, owning a home can be expensive, especially if you find issues that need immediate repair.

However, with many of these repairs improving the condition and appeal of the property, which can actually increase the value to potential buyers, perhaps they are better viewed as an investment rather than a cost.

When preparing for a repair make sure that you obtain a range of quotes so that you can choose the best and most cost-effective option for you.

Set a realistic budget, and carefully monitor the project to ensure that the costs don’t spiral out of control. Should you need to make more than one repair, prioritise the most urgent.

When considering how to pay for essential repairs, carefully consider your financial situation and what you can realistically afford. Problems repaying loans can have a considerable impact on your future ability to borrow money or take out credit.