Buying a house is an exciting as well as scary prospect. So you want to make sure you do the right thing, like getting a survey done. But which one? Find out what are the different types of house surveys in the UK.

When you buy a home, the property survey is your ultimate tool to find out as much as you can about the condition of the property. At best, it will give you a list of repairs you will have to carry out once you have moved in.

At worst, it will discover an issue that could cost you dearly if you bought the house without knowing it. We have been saved by a property survey from getting ourselves into a costly adventure once, so highly recommend that you carry one out.

The question is just which one? There isn’t just one house survey you can get done, so choosing the right one for your purchase is vital.

Here we discuss each of these different surveys so that you have all the information you need to make the right choice for you.

Buying A Property? FREE Step-By-Step Platform

The Different Types Of House Surveys To Choose From

While most people know the homebuyers and building surveys, there are actually six types of property surveys to consider.

Which one is the right for you will depend on the needs of the property you are looking to buy. To decide, you need to know what each of these surveys is about. So here you go…

1. Valuation Survey (Approx £200)

This is commonly the one that your mortgage lender will carry out as a condition of your mortgage. Its primary purpose is to provide an accurate valuation of the property to ensure you are not overpaying for the home.

Although it may point out any major issues that will affect the value of the home, it should not be relied upon to uncover defects.

While we’ve had valuation surveys done to satisfy the mortgage company, we’ve never relied on them as a good indicator of issues. That said, we did once lose a mortgage on a property because the valuation survey highlighted a serious structural issue on the extension.

We wouldn’t recommend having this as your only survey, unless you’re buying a brand-new home. These tend to come with a warranty for structural as well as fixtures and fittings warranty.

2. Condition Report (Approx £300)

This type of survey is designed to complement a valuation survey by going into a little more detail about the exact condition of the property and any repairs that may need to be made.

However, it does not provide advice as to what you should do about any of the issues it uncovers.

If you are buying a standard property that hasn’t been extended in any way and is in good condition, then this type of survey might be enough.

Again, this is not a type of survey we’ve ever really used ourselves since it doesn’t cost much more to do a homebuyers report which is much more comprehensive…

3. Homebuyers Report (Approx £400)

The Homebuyers Report is a more detailed version of the condition report and will check for signs of rot, damp, subsidence, and more. It’s probably the most common report of all the different types of house surveys you can get.

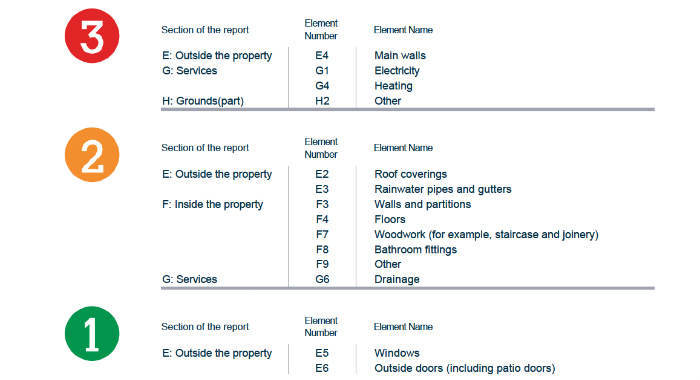

It will also provide advice on the best way to approach any problems uncovered. Typically, a ‘traffic light’ system is used to help identify which problems are minor, and which are potentially more serious.

Keep in mind though that it’s a non-intrusive survey, so the surveyor won’t drill into walls, move furniture, or pull up floorboards. This means it’s still limited in what it will uncover.

You can download an example Homebuyers Report, here.

This is the type of report we usually go for. The exception is when we are particularly concerned about an issue or range of issues, then we might skip and go straight to a more specialist report.

For instance, in our current home, the sellers had a homebuyers report from when they bought the property 2 years previously. As the property appeared well cared for, we felt it didn’t make sense to get a new one done.

However, since the property was quite old and had a few signs of damp, we opted for a damp and timer report instead. Which leads us nicely to our next survey type…

4. Damp And Timber Survey (£300+)

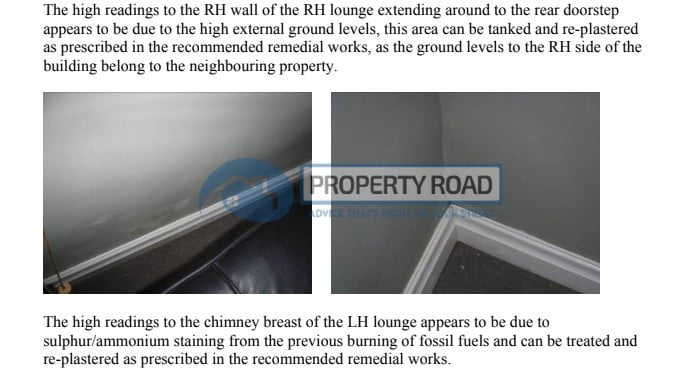

This specialist survey will only focus on two things: damp and issues with timber. You would only get this survey done if you have noticed damp issues or signs of woodworm damage or similar during the viewing.

Alternatively, a Homebuyer Report might have brought up such issues and recommended this survey. In either case, this is a survey you only choose if you have particular concerns around damp or timber damage.

Like we had when we purchased our current home. It cost us just over £400 but gave us complete peace of mind about exactly what was causing the damp issues and how we could resolve them.

What is great about this type of survey is that it will establish the cause of the damp or timber damage, recommend how to fix it and how much it will cost you.

This will help you decide whether you can afford the necessary repairs at the price you offered or if you have to renegotiate with the sellers.

5. Building Survey (£500+)

This type of survey is the most expensive but also the most comprehensive. The surveyor will go into the loft space, check under floors and behind walls to uncover every issue they can find.

It will also give you the most detailed advice about how to approach repairs, what they will cost, and what the consequences are of not carrying them out.

It, therefore, gives you the most complete overview of the property and the things you need to be concerned about.

6. Structural Survey (£500+)

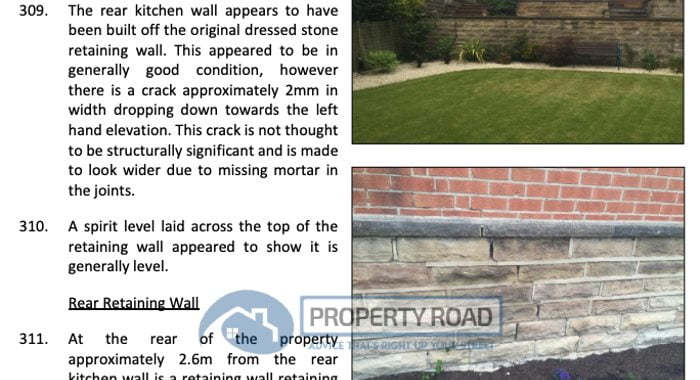

Alongside a building survey is a structural survey which is conducted by a structural engineer. These types of survey are used when there is a specific concern around the structural integrity of a property.

While the whole property is usually checked, the report will often focus on any known issues and provide advice whether any action is required and the potential costs involved.

The report will often be backed by a guarantee, meaning if the report turns out to be inaccurate, you may be able to claim for the additional costs you incurred in rectifying a misreported issue.

We had a structural survey done on a property we were looking to buy after our Homebuyers Report identified some pretty major sounding issues to do with subsidence.

Essentially, the extension was built on top of a retaining wall that wasn’t designed to take the weight of the extension and cracks had appeared. The surveyor who conducted our Homebuyers Report had stated that the cracks were significant and the extension ‘probably needed underpinning’.

Naturally, that scared the life out of us, and we nearly walked away. However, it was our dream home, so we decided to invest in a structural survey.

The structural engineer visited the property and concluded that, while there had been some movement, the issue was long-standing and non-progressive – meaning that it was safe for us to proceed with the purchase.

Sure, it added on a little extra cost to our purchase, but it was worth it for the peace of mind. It also came in very handy when we sold the property as we had something to show the surveyor to avoid a repeat of the scaremongering our surveyor had done on us!

You can download an example of the structural survey we had done here.

Some chartered surveyors specialise in conducting certain types of surveys. Therefore, deciding which type of survey you require is the first step towards choosing the right chartered surveyor.

Choosing The Right Type Of Survey Is Vital

With quite a few different types of house surveys available, it might feel a bit overwhelming to choose the right one for you. After all, you want to make sure that you find out any issues before you complete the purchase.

In most cases, the Homebuyers Report is the perfect level of survey as it gives a good overview of the condition of the property. With its traffic light system, it’s easy to see which issues are urgent and which don’t have to be done immediately.

In our experience, the more comprehensive or specialised surveys are only necessary if you have spotted a specific issue or if the Homebuyers Survey has brought one up. Or if you are looking to buy a doer upper that needs a lot of work done.

Properties that have been widely extended might also benefit from a more in-depth survey, especially if the extensions are older or haven’t been done according to building regulations.

The same is true for older properties, built before 1940s, or listed buildings.

In these cases, a Building Survey might be the better option, as it will delve deeper into the building’s fabric and structure. Hopefully, the information we have provided above will help you choose the right survey for you.

And if you are looking for a RICS chartered surveyor to carry out the survey, but are unsure which one to use, our article about how to choose a chartered surveyor will help you with that too. Otherwise, use our handy tool below to find your chartered surveyor today.