Luton Reclaims Title As England And Wales Buy-To-Let Hotspot

- News

- 2 min read

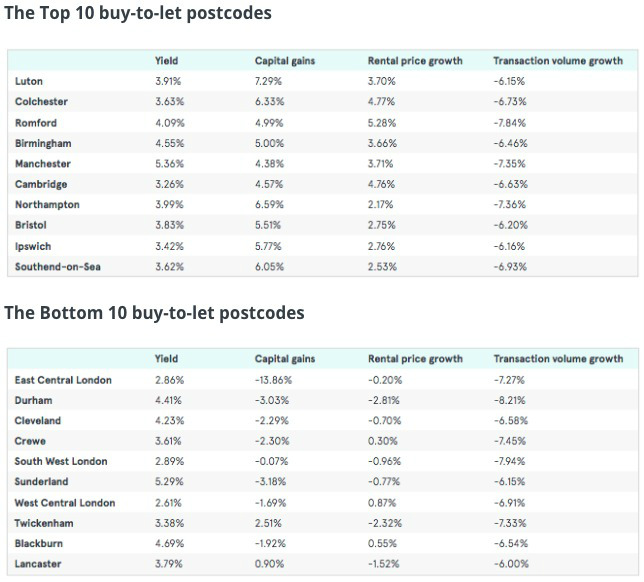

The town of Luton has topped the rankings for the best places to invest in buy-to-let property in England and Wales for the third time since December 2016.

The rankings take into account capital value growth, transaction volumes, rental yield and rental price growths in 105 postcode areas across England and Wales.

The report, published quarterly by property finance marketplace, LendInvest, has also identified Colchester, Romford, Birmingham, and Manchester as the next best places for landlords to invest.

Cambridge and Bristol also found themselves in the top 10. However, it wasn’t such good news for Lancaster, Blackburn and Twickenham who came bottom of the pile.

The index also looks into transaction volume growth slowdown across various towns and cities. The latest data suggests there is a dip in transaction volumes but a spike in remortgage deals.

Ian Boden, Sales Director at LendInvest, said: “It’d be so easy to look at the underlying data that tells us transaction volumes are down and make dire predictions about the health and wealth of the rental market. Instead, what our Index proves once again is that looking at one metric in the housing market is never enough. One metric on its own can’t clearly define the performance of a city’s property market.

“Each of the very top performing BTL locations this quarter is experiencing a slowdown in transactions – substantial falls in places, dips in others. But, the best places this quarter continue to outperform the competition well thanks to strong performances on other, equally important metrics like rental yield, capital gains and rental price growth.

“Data from the BTL Index, UK Finance and our own experience as a mortgage lender strongly suggests that right now a ‘buy, hold and remortgage’ strategy is some investors’ preference while the market works through a possible slowdown.”

Therefore, it would appear that a significant number of landlords are choosing to hold on to their properties and await a more buoyant market before looking at an exit strategy.

Related topics

Related topics

Most read articles

As featured in